Job growth in the United Arab Emirates reaches its highest speed in seven years so employees and employers need proper understanding of their salary information. Understanding a proper salary slip helps you see your earnings with transparency and it functions as a necessary document for financial activities. This complete document provides UAE employees with complete information about salary slip standards and their structural elements together with their essential role.

Understanding Salary Slip Basics in the UAE

The salary slip (also known as payslip) serves as an official document which presents all employment details and breaks down employee compensation in full detail. All employees in the UAE regardless of their working schedule and their contractual agreement must receive their payslip in physical or electronic form.

Employees in the UAE receive their salaries automatically through the Wage Protection System (WPS) according to Labor Ministry rules which specify payments must happen within ten days following the payment period. The UAE national currency serves as the exclusive payment method for all workers and transactions need to occur during weekdays only.

Also Read

Why Your Salary Slip Matters

Your salary slip carries essential value that extends past knowing your monthly payment amount:

- Legal Proof of Income: Your salary slip serves as legal evidence of your earnings and deductions, which is essential for various financial activities.

- Access to Benefits: It’s necessary for receiving applicable government benefits, medical benefits, or subsidies.

- Financial Planning: A clear understanding of your salary structure helps in effective tax and financial planning.

- Loan Applications: Banks and financial institutions require salary slips as proof of income when applying for loans, credit cards, or mortgages.

- Visa Applications: Salary slips are often required for visa applications, both within the UAE and for international travel.

- Employment Verification: They serve as proof of employment when needed for various official procedures.

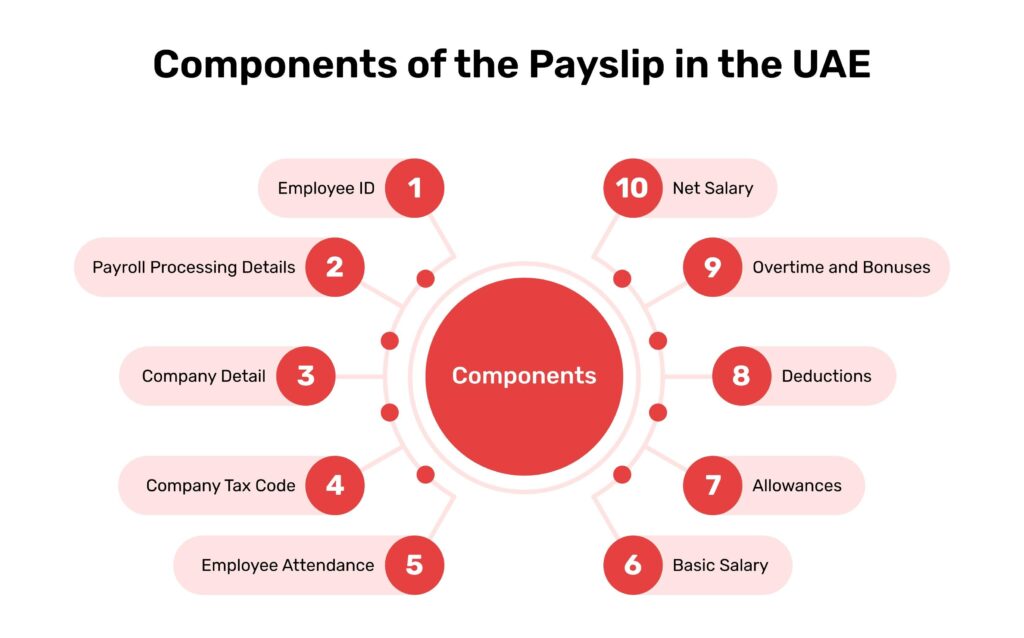

Essential Components of a UAE Salary Slip

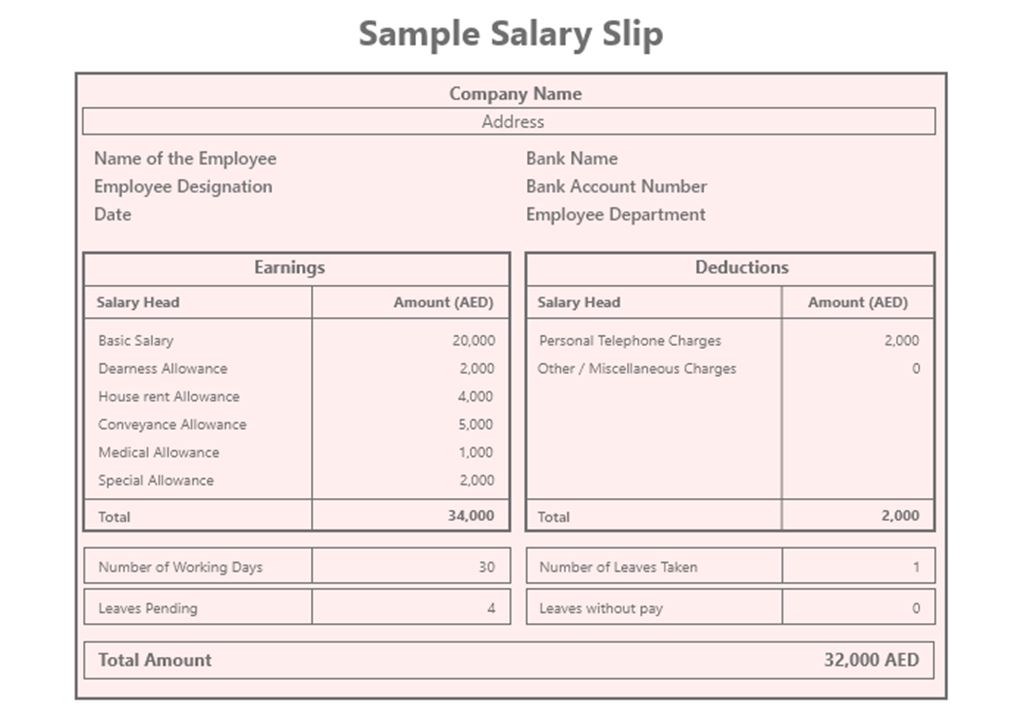

Every employee in the UAE should understand the essential components which make up the standard salary slip format:

Employee and Company Information

- Payroll/Employee ID: A unique identifier assigned to each employee

- Company Details: Name and address of the employer

- Payment Period: The fortnight or month for which the salary is being paid

- Employee Details: Name, designation, department, joining date

Salary Components

- Basic Salary: Usually 40-60% of your Cost to Company (CTC)

- House Rent Allowance (HRA): An allowance provided especially for foreign workers to cover accommodation costs

- Conveyance/Transportation Allowance: Compensates employees for their commute to and from work (if company transport isn’t provided)

- Medical Allowance: Reimbursement for medical expenses as part of the employee benefits plan

- Overtime Pay: Compensation for working beyond standard working hours, calculated at a minimum of 25% above the base pay

- Other Allowances: May include special allowances, performance bonuses, or other incentives

Financial Calculations

- Gross Salary: The sum of basic salary plus all allowances

- CTC (Cost to Company): The total expense an employer incurs for an employee

- Deductions: Any amounts subtracted from the gross salary

- Net Salary: The final amount you receive after all deductions (Gross Salary – Deductions)

Banking and Payment Information

- Bank Details: Name of the bank, account number

- IBAN Number: The 23-character International Bank Account Number used for salary transfers through the WPS system

Understanding Deductions in UAE Salary Slips

The UAE differs from most other nations by enforcing minimal standard deductions:

- Pension Contributions: For UAE nationals only, 5% of salary is withheld as pension contribution (employers contribute 12.5%). Foreign employees are exempt from this deduction.

- Leave Deductions: Adjustments for unpaid leave or excess leave taken

- Salary Advances: Deductions for any salary paid in advance

- Other Deductions: May include penalties, violations, or other contractual deductions

Difference Between CTC and Gross Salary

A large number of staff members mix up Cost to Company (CTC) with gross salary payments. Here’s the clear distinction:

- CTC: The total annual expenditure by the employer on an employee, including salary, contributions, and benefits.

- Gross Salary: The monthly amount paid before any deductions, typically comprising basic pay and various allowances.

The formula is:

- CTC = Gross Salary + Employer Contributions + Benefits

- Gross Salary = Basic Salary + HRA + Other Allowances

- Net Salary = Gross Salary – Deductions

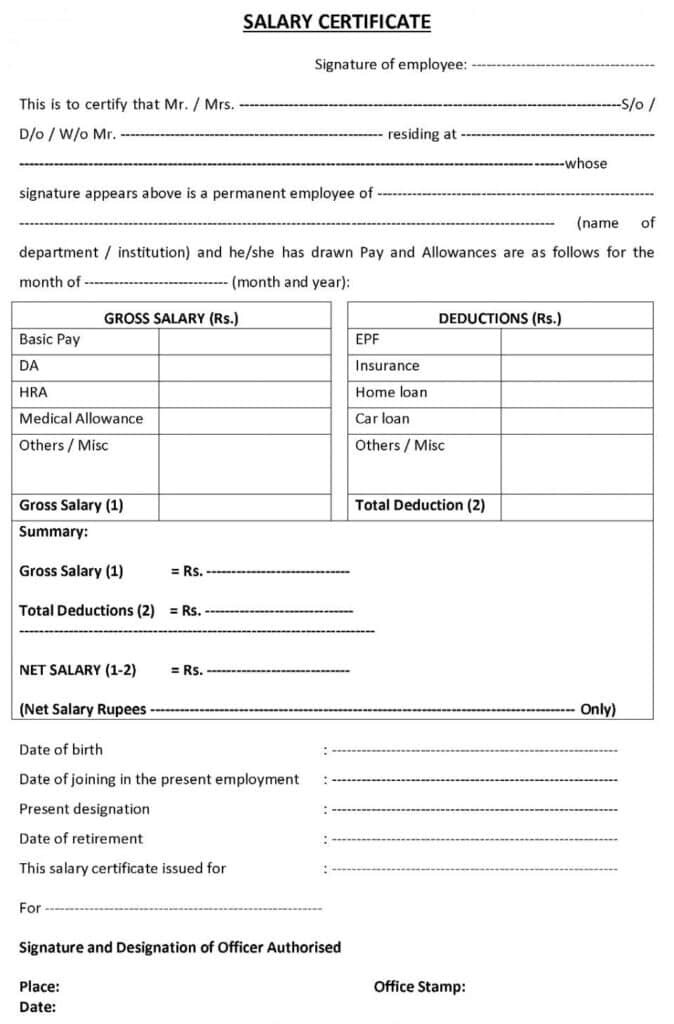

Salary Slip vs. Salary Certificate

A salary slip presents significant differences compared to a salary certificate when examined through various essential elements:

Salary Slip:

- Provided monthly

- Includes detailed breakdown of salary components

- Shows specific deductions and earnings for the month

- Primarily for the employee’s reference

Salary Certificate:

- Issued on request

- Printed on company letterhead with official seal

- Verifies employment and salary without detailed breakdown

- Often directed to a specific institution (bank, embassy, etc.)

- Used for specific purposes like loan applications or visa processing

Digital vs. Paper Salary Slips

Organizations conducting business in the modern UAE market are progressively adopting electronic salary slip systems:

Digital Salary Slips:

- Environmentally friendly

- Securely stored in the cloud

- Accessible anytime from anywhere

- Easier to manage and archive

- Cannot be physically lost or damaged

Paper Salary Slips:

- Traditional format

- Physical proof of payment

- May be preferred by some employees

- Requires physical storage and organization

The legal validity of electronic and paper salary slips in the UAE remains equal if they correctly fulfill all official information requirements.

Download Free UAE Salary Slip Templates

Our organization provides ready-to-use templates for salary slips that follow UAE standards so you can implement the proper format in your organization. Modifiable templates allow organizations to make their required formatting changes adapted to their branding infrastructure.

You can download our UAE salary slip templates through this link in any desired format:

The templates encompass all the necessary elements that must appear on a UAE salary slip between employee details and salary breakdown and allowances and deductions and payment information. The templates allow users to select their preferred format then add company details followed by salary component adjustments based on organizational policy.

Importance of Keeping Your Salary Slips

It is essential to keep all salary slips in a permanent record for these six important reasons:

- Tax Documentation: For expatriates who may need to file taxes in their home countries

- Loan Applications: Required by financial institutions for credit approval

- Visa Processing: Often needed for residency visa renewals or new applications

- Employment History: Provides proof of previous employment and income

- Financial Planning: Helps track income growth and financial progress

- Government Subsidies: May determine eligibility for various government schemes

Legal Considerations for UAE Salary Slips

The UAE labor laws treat salary slip modification or falsification as a punishable criminal offense. Employers together with employees need to verify that all documents remain accurate and genuine. The Ministry of Human Resources and Emiratisation through MOHRE implements comprehensive rules for employee wage payments together with their supporting documentation.

What to Do If You Don’t Receive a Salary Slip

You are required to obtain salary information from your employer in case they fail to issue regular slips:

- Directly request your salary slip by approaching your HR department or payroll team.

- A salary certificate can serve as an acceptable substitute to demonstrate your income

- You have the right to file a complaint to MOHRE in case of persistent denial.

- Maintain personal records of all bank deposits that show payment receipts

Your salary slip serves as an essential document which determines your financial plans while affecting your loan eligibility and multiple official procedures. UAE employees who understand salary slip formats and elements gain better financial decision-making abilities and establish transparent workplace relationships with their employers.

Employment growth in the UAE demands employees and employers to focus on proper salary documentation to uphold labor regulations and enable seamless financial operations. Employees who understand their salary slips obtain important details about their compensation packages and financial position regardless of their work experience in the UAE.