Bank balance surveillance stands as an essential practice for anyone practicing financial management. First Abu Dhabi Bank (FAB) operates as the largest banking institution in UAE to offer various safe and accessible ways for customers to view their account balances through standard accounts and Ratibi salary cards and business accounts.

The guide presents an exhaustive overview of all FAB balance inquiry procedures which are official in 2025 with detailed instructions and troubleshooting tips and security guidelines.

The Importance of Regular Balance Checks

Regular checks of your FAB account balance bring multiple important advantages to your financial management:

Also Read

- Prevents Overdrafts – Knowing your available funds in advance stops you from going into overdraft situations.

- Detects Unauthorized Activity – The system helps customers discover unauthorized activity because it identifies fraudulent transactions in a timely manner.

- Tracks Salary Deposits – Ratibi cardholders can verify their salary deposits through the tracking feature of the system.

- Improves Budgeting – Budgeting becomes better through the ability to see spending patterns from your FAB account.

Methods to Check Your FAB Balance

1. FAB Mobile Banking App

The FAB Mobile App delivers the quickest route to view your account balance along with maximum efficiency.

Steps to Check Balance via Mobile App:

- You can obtain the FAB Mobile App through both Apple App Store and Google Play Store.

- Users need to log in with their registered credentials although new users must first create their accounts.

- View your present balance by going to the “Accounts” section under the FAB platform.

Additional Features:

- Real-time transaction history

- Fund transfers between FAB and external accounts

- Bill payments and credit card management

2. FAB Online Banking

Users accessing FAB Mobile App through desktops should follow this sequence of steps:

- Visit the official FAB website.

- Enter your login details after selecting “Login” on the website.

- The Account Summary section contains your balance information for viewing.

Quick Balance Check for Ratibi Cardholders:

- Users can reach the FAB Balance Inquiry Portal through this process.

- To check your FAB account balance use the last two numbers of your card number together with your Card ID.

- Click “Go” to rapidly view your current balance on the screen.

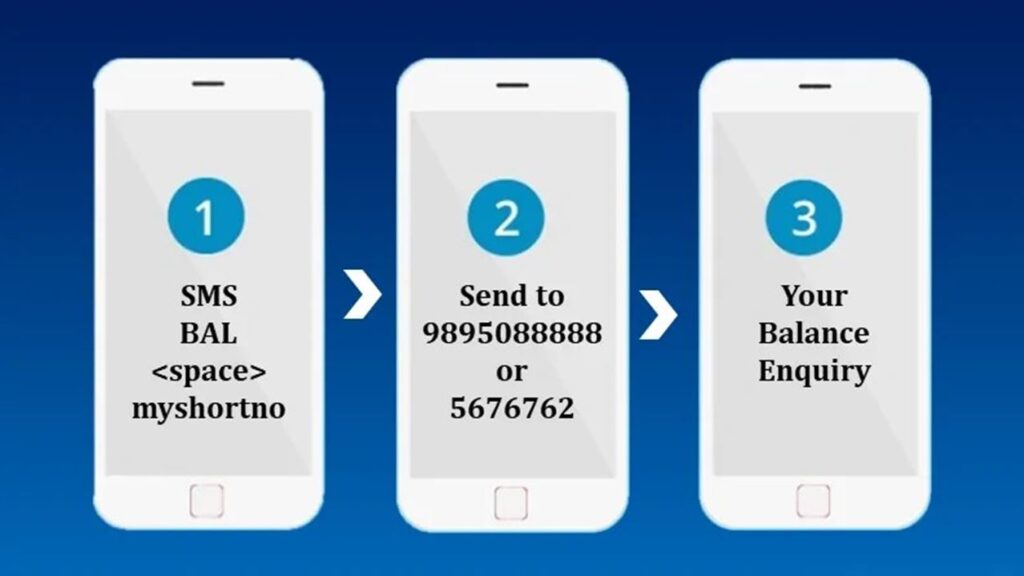

3. SMS Banking

Balance inquiries are possible without internet access through the SMS Banking service:

- The FAB online banking portal enables customers to sign up for SMS Banking.

- Start a new text message by typing “BAL” then completing it with the final four numbers of your account number.

- You must send your message to 2121 (alternatively to 1214 based on your account type).

- You will automatically get an SMS message that shows your present account balance.

Note: Standard SMS charges may apply.

4. ATM Balance Inquiry

Users can access their account balance through any FAB ATM by using their debit card or Ratibi card:

- Insert your FAB card into the ATM.

- Enter your 4-digit PIN.

- Select “Balance Inquiry” from the menu.

- Choose whether to display the balance on-screen or print a receipt.

Tip: Using non-FAB ATMs may incur additional fees.

5. FAB Customer Service

By Phone:

- Call 600 52 5500 (UAE) or +971 2 6811511 (international).

- Verify your identity with customer support and request your balance.

In-Person at a Branch:

- The FAB branch locator helps you identify the nearest FAB location.

- You need to show your Emirates ID and debit card to a bank representative at their counter for help.

6. Email Alerts & Mobile Wallets

- To receive automatic balance updates you should enable email notifications inside your FAB online banking settings.

- You can link your FAB card to Google Pay or Apple Pay to access your balance information easily.

How to Activate and Check Salary on a Ratibi Card

The Ratibi card operates as a payroll solution which serves UAE-based employees.

Activation Steps:

- Place your Ratibi card into a First Abu Dhabi Bank ATM.

- Follow the instructions to select “Set PIN” before creating a 4-digit PIN.

- Your card is prepared to function.

Checking Salary Deposits:

Verify salary deposits through any of the six available methods which include Mobile App, SMS, ATM and others.

Troubleshooting Common Balance Check Issues

| Issue | Solution |

| App or website not loading | Check your internet connection or try again later. |

| Incorrect login credentials | Reset your password via FAB’s online banking portal. |

| Card blocked or lost | Immediately call FAB customer service at 600 52 5500. |

| Balance discrepancy | Review recent transactions or contact FAB for clarification. |

Security Best Practices for FAB Banking

- You must never reveal your PIN and OTP and online banking credentials to anyone.

- Two-factor authentication (2FA) should be used as an additional security measure.

- Online users must stay away from clicking links that appear suspicious in their received emails or messages.

- You should logout from online banking whenever you complete a session.

Which Balance Check Method is Best?

| Method | Best For | Speed |

| Mobile App | Instant access, full account management | Fastest |

| SMS Banking | No internet required | Quick |

| ATM Check | Cash withdrawals + balance inquiry | Moderate |

| Online Banking | Desktop users | Fast |

For most users, the FAB Mobile App provides the fastest and most secure experience.

Frequently Asked Questions (FAQs)

Is there a fee for checking my FAB balance?

Most methods are free, but SMS banking may incur a small charge.

Can I check my balance without my debit card?

Yes, via mobile app, online banking, or customer service.

How do I download my FAB bank statement?

Log in to the FAB Mobile App, go to “Services”, and select “Download Statement.”

What is the difference between NBAD and FAB?

The National Bank of Abu Dhabi (NBAD) merged with First Gulf Bank (FGB) in 2017 to form First Abu Dhabi Bank (FAB).

Need Assistance? Contact FAB

- UAE Customers: Call 600 52 5500

- International Customers: Call +971 2 6811511

- Website: www.bankfab.com

Following the methods outlined in this guide allows you to check your FAB account balance at any time using mobile banking and ATMs as well as SMS messages and online banking. Regular account balance checks serve to monitor financial activities along with securing early identification of fraud patterns and preventing overdraft fees and ensuring timely salary deposit reception.

Your security should be your first priority both through password strength and two-factor authentication to perform safer payments. FAB provides dedicated customer support which helps customers solve any encountered problems. These simple steps about financial updates help users manage their money better and bring peace to their financial life.